The Single Strategy To Use For Financial Advisor Victoria Bc

Wiki Article

What Does Financial Advisor Victoria Bc Mean?

Table of ContentsThe Only Guide for Ia Wealth ManagementA Biased View of Independent Investment Advisor CanadaAll About Private Wealth Management CanadaHow Lighthouse Wealth Management can Save You Time, Stress, and Money.The Ultimate Guide To Independent Investment Advisor CanadaThe smart Trick of Tax Planning Canada That Nobody is Discussing

“If you were to get a product, say a television or some type of computer, you would want to know the requirements of itwhat are their parts and exactly what it is capable of doing,” Purda details. “You can think about getting financial advice and help in the same way. Individuals must know what they're purchasing.” With economic information, it is important to understand that this product is not ties, stocks and other financial investments.It’s such things as cost management, planning your retirement or reducing debt. And like purchasing a computer from a trusted business, consumers need to know they're buying monetary advice from a dependable expert. One of Purda and Ashworth’s most interesting conclusions is just about the costs that monetary coordinators charge their customers.

This held real regardless of the charge structurehourly, commission, assets under control or predetermined fee (inside the learn, the buck value of charges was equivalent in each situation). “It still comes down to the worthiness idea and uncertainty from the consumers’ part which they don’t determine what these are typically getting into exchange of these charges,” claims Purda.

All about Retirement Planning Canada

Listen to this informative article as soon as you notice the word economic specialist, just what pops into their heads? Many people think about a professional who can give them financial advice, specially when you are looking at investing. That’s a good starting point, however it doesn’t color the photo. Not really near! Economic analysts will help people with a lot of different cash objectives as well.

An economic advisor will allow you to develop wide range and shield it for your long lasting. They can approximate your future monetary requirements and program techniques to extend your own retirement savings. They could also give you advice on when you should start experiencing personal Security and making use of the income in your retirement records to help you prevent any nasty charges.

Independent Financial Advisor Canada for Dummies

They may be able let you ascertain exactly what shared resources tend to be right for you and demonstrate how exactly to control and come up with probably the most of your own investments. They're able to in addition help you see the risks and exactly what you’ll should do to get your goals. A seasoned investment professional can also help you stay on the roller coaster of investingeven whenever your investments take a dive.

They are able to supply you with the direction you should produce a plan to help you ensure your wishes are performed. And also you can’t put an amount tag regarding comfort that include that. Per a recent study, the average 65-year-old couple in 2022 should have about $315,000 saved to pay for health care prices in your retirement.

The Definitive Guide for Investment Representative

Since we’ve reviewed exactly what economic analysts carry out, let’s dig into the various types. Here’s a beneficial guideline: All economic planners tend to be financial experts, not all experts are planners - https://community.simplilearn.com/members/carlos-pryce.5767391/#about. A monetary planner centers on helping men and women generate intentions to achieve lasting goalsthings like beginning a college investment or saving for a down cost on a house

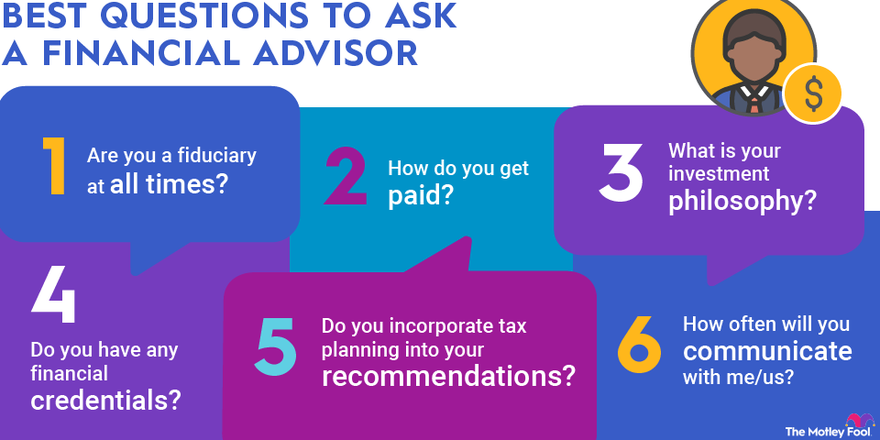

How do you know which economic advisor is right for you - https://visual.ly/users/carlosprycev8x5j2/portfolio? Below are a few activities to do to make sure you are really employing the best individual. What do you do when you have two terrible options to pick from? Simple! Get A Hold Of a lot more choices. More solutions you check really have, the more likely you are to make a choice

Tax Planning Canada for Beginners

Our very own Intelligent, Vestor program causes it to be simple for you by revealing you to five economic advisors who is going to last. The best part is actually, it’s completely free for connected with an advisor! And don’t forget to get to the interview prepared with a list of concerns to inquire about so you can find out if they’re a great fit.But tune in, even though an advisor is wiser versus ordinary bear doesn’t provide them with the legal right to tell you how to handle it. Sometimes, experts are full of themselves because they do have more levels than a thermometer. If an advisor begins talking down to you personally, it’s time to demonstrate to them the entranceway.

Just remember that ,! It’s essential as well as your monetary specialist (anyone who it eventually ends up getting) take equivalent web page. You want a specialist who's a long-lasting investing strategysomeone who’ll motivate you to keep spending regularly perhaps the marketplace is upwards or down. lighthouse wealth management. You also don’t like to utilize somebody who pushes you to buy something that’s also risky or you’re unpleasant with

The smart Trick of Financial Advisor Victoria Bc That Nobody is Talking About

That mix gives you the diversity you need to effectively spend when it comes to long term. Whenever research financial advisors, you’ll probably stumble on the word fiduciary duty. All this work suggests is actually any specialist you hire has to act in a manner that benefits their unique client rather than their own self-interest.Report this wiki page